How Much Will SSI Checks Be In 2022?

Supplemental Security Income (SSI) benefit payments were sent to more than 7.7 million people every month. Each of those people were eligible for SSI benefits because they fit the needs-based income eligibility criteria and they suffer some disability recognized by the Social Security Administration (SSA).

The Clauson Law Firm specializes in getting every disabled person the maximum benefit possible based on their individual circumstances. If you think you are eligible for SSI benefit payments, please don’t wait to contact our experienced SSI lawyers who can help you understand how you may meet the requirements to get your monthly benefits from SSI. If you were denied SSI benefits, contact Clauson Law immediately so we can tell you about your appeal rights and help you fight to change the denial notice you received.

How Are Supplemental Security Income (SSI) Benefit Amounts Determined?

First, SSI is an entirely different program than SSDI. (see next section) In the SSI program, the maximum possible benefit amount is the starting point for every SSI applicant or recipient. Then, based on several factors, the maximum benefit amount is reduced by your countable income and/or available financial resources.

Because every SSI benefit recipient has a unique quantity of monthly income amounts, each person may receive a different monthly benefit payment.

The factors that affect your ultimate monthly benefit payment amount are these:

- how much countable income you have in a month (gets deducted from maximum amount)

- what is the value of your countable financial resources (assets) (affects eligibility)

- whether only one spouse or both spouses are eligible

- whether you are an eligible essential person (since 1973)

Here are the 2022 maximum amounts of your monthly SSI check, the starting points:

- individual maximum benefit = $841

- married couple, both spouses eligible for benefits = $1,261

- essential person benefit amount = $421

Your monthly SSI benefit check’s amount will depend on how much countable income gets deducted from the maximum payment based on your income.

How Is Supplement Security Income (SSI) Different from Social Security Disability (SSD)

The Social Security Administration has three different programs paying benefits to different populations of eligible recipients:

- the Old Age, Survivors and Disability Insurance program (Retirement),

- the Social Security Disability Insurance program (SSD or SSDI), and

- the Supplemental Security Income program (SSI)

The two programs that are often confused are SSD and SSI. But the eligibility requirements and the formula used to calculate benefit amounts are entirely different.

Social Security Disability (SSD) benefits are only available to long-term workers who paid payroll or self-employment taxes for a sufficient number of years and who are disabled enough to qualify for SSD program benefits. SSD benefit amounts are based primarily on the recipient’s average lifetime annual earnings.

Supplemental Security Income (SSI) is a needs-based program serving disabled people with low incomes and very limited financial resources. SSI recipients need not ever have worked. SSI benefit amounts are based solely on the maximum benefit reduced by the recipient’s countable income.

The only significant feature the two programs share is the criteria for what qualifies as a disability.

How Is Your “Countable Income” Used to Determine Your SSI Payment Amount?

The Social Security Administration (SSA) understands that the monthly SSI benefit payment is not enough to cover all of your living expenses, even if you live very modestly. The government knows that by qualifying for SSI benefits, you are also eligible for other need-based federal, state, or local publicly funded programs.

The maximum monthly SSI benefit payment amount of $841 for an individual is set with the expectation that you will be able to access other available relief benefits. As a needs-based program designed for low-income individuals and families, the SSA must take steps to ensure that the SSI program’s limited funds don’t go to people whose income and resources exceed the eligibility level.

To sort the neediest recipients from those who are less needy, the SSA adopted the practice of excluding a number of items and designating others as either “countable income” or “non-countable income.”

What Does SSI Consider Income?

The term “income” has a special definition for the Supplemental Security Income program. The SSA defines income as

“any item an individual receives in cash or in-kind that can be used to meet his or her need for food or shelter. Income includes, for the purposes of SSI, the receipt of any item which can be applied, either directly or by sale or conversion, to meet basic needs of food or shelter.”

Income that SSI tracks include your, wages, net earnings from self–employment, certain royalties, honoraria, and sheltered workshop program payments, Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives.

The key to identifying what can be used to pay for or raise money to pay for food or housing. That includes “in-kind” and “deemed income.”

In-kind income housing or food you receive for free or for less than fair market value. If your apartment would normally rent for $1,500 per month and you pay only $1,100, then you are receiving $400 of in-kind income.

Deemed income is income the part of someone else’s income that SSI credits as yours. For example, if your spouse is not SSI eligible but lives with you and pays part of your food and shelter expenses, then a portion will be deemed to be income to you.

What Is Excluded from Consideration by SSI?

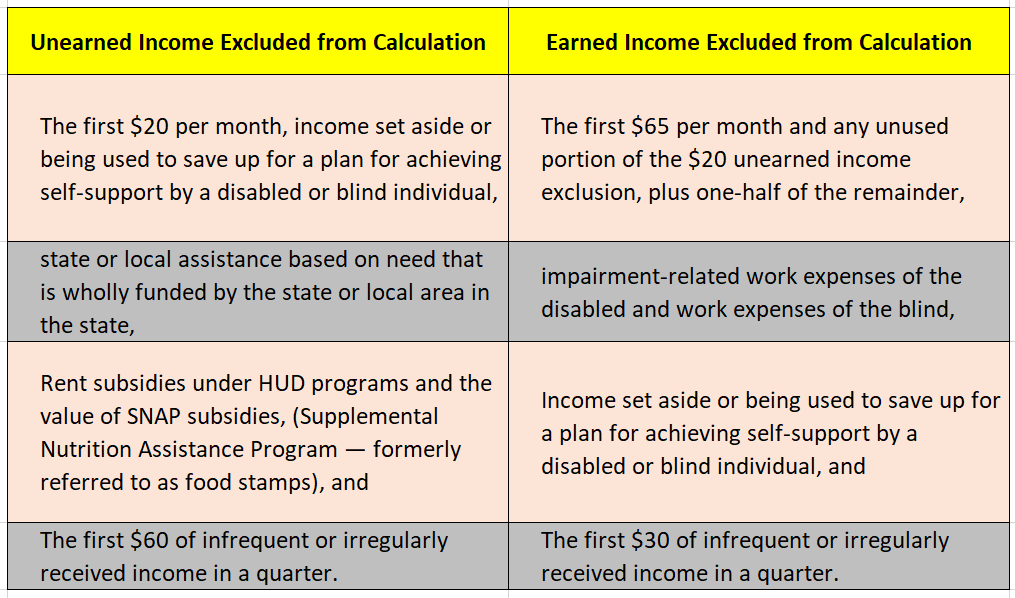

Excluded from any consideration in the calculation of your SSI benefit payment amount are some unearned income and some earned income. The list of exclusions includes others not listed here, but these are the main exclusions:

What Is Non-Countable Income?

Non-countable income is what you receive from the sources listed here for which the SSA understands you could be eligible and which will assist you in meeting your daily living expenses where your SSI benefit falls short:

- medical care

- cash loans or “in-kind” (non-monetary) loans that you have agreed to repay

- grants and scholarships used for educational expenses

- income tax refunds

- home energy assistance

- food or shelter provided by a nonprofit agency

- state or local needs-based assistance

- disability-related work expenses

- for students under 22, earned income of not more than $1,930 per month or $7,770 per year (in 2021)

- money spent by others on your expenses, including your phone bills, utility bills, or medical bills (anything other than food and shelter).

What Is Countable Income That Reduces Your SSI Benefit Amount?

Countable income is the amount of money deducted from the maximum benefit after excluding the items listed above (exclusions).

This countable income deduction is figured for every calendar month, meaning that your SSI monthly benefit payment amount can change from month to month as your countable income varies.

In the simplest terms, it is any money or thing of value you receive that is not otherwise on the list of exclusions or on the list of non-countable income.

Calculating Your Monthly SSI Payment Amount

As an example of how the SSI figures the amount of your benefit payment for any single month, let’s look at a few cases just for illustration.