Our main advice for buyers in this still-tricky market is to act quickly and negotiate from an informed perspective. That can make the difference between getting a fair deal or paying too much. Also, it’s never been more important to make sure your credit is in good shape. Interest rates are up, but the most competitive rates are reserved for those with strong credit ratings.

Here are some other ways to make the best of a challenging market.

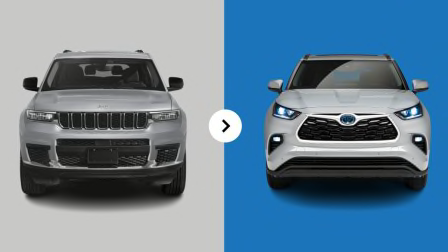

Consider buying a new car. New-car availability is gradually improving, although inventory is a bit thin among certain models, says Alain Nana-Sinkam, principal at Triple Double Automotive, a firm that tracks market trends. That means manufacturers have started to bring back attractive lease and financing deals that had been absent when availability was limited. On the other hand, newer used cars—models in the 1- to 3-year-old range—may be listed at prices relatively close to what they sold for new, and without the manufacturer-subsidized financing offered to qualified buyers on some brand-new models.

If you have to borrow money to buy a car, keep in mind that the older the car, the more interest a lender will charge. And with new cars, there’s also the added benefit of a fresh factory warranty. Check dealer incentives in your area and see what’s being offered. Availability is especially good right now among new EV models, says Nana-Sinkam.

Look at older models. With more car buyers jumping on new-car deals, prices have begun to ease on used models. But people are still paying more than ever for both new and used cars, which makes older models a practical choice for anyone with a budget to maintain.

However, if you decide to buy an older car, Consumer Reports recommends looking at models known for reliability. Models more than 5 or 6 years old aren’t likely to still be covered by a factory warranty (although many EVs have 10-year warranties). You can purchase an extended warranty or service plan, but it’s usually better to save what you’d spend on those for future repairs. The downside is that if you have to finance the purchase, interest rates tend to be higher on loans for older cars.

Shop used EVs. Pat Ryan, CEO of CoPilot, a car-shopping app that tracks used-car values, says that used EV prices have dropped 26 percent over the last year. The best deals, though, may be found among used Teslas, which are selling for 39 percent less than they were last year.

Prearrange financing. Figure out your budget and get financing based on what you can afford to pay monthly and as a down payment. It’s always a good idea to get financing through your bank or credit union before going to a dealership to look at cars. That way you have a baseline against which you can compare the terms of dealer financing, which may or may not be as good a deal.

As always, getting financing secured for a private-party sale is a little more difficult. You’ll need to have the funds secured and ready to pay out so that you’re able to buy a car quickly if you find one that’s reliable, fuel-efficient, and meets your other needs.

Cast a wide net. Prices outside your area may be better. You can find a good variety of used models on websites like TrueCar.com, operated by a CR partner, and through Consumer Report’s Used Car Marketplace. Expand your geographic search if you need to. Be cautious about searching too far from home. You want to be able to go see any car you’re considering buying and test-drive it before signing a sales or leasing contract. This is especially true for used cars. The market hasn’t completely settled down yet, so if the car you’re looking at seems like a good deal, someone else might scoop it up from underneath you if you have to travel too far to get to it.

Do your research. Whether buying new or used, consult Consumer Reports’ road tests and ratings, looking closely at reliability, owner satisfaction, and safety. Make a short list of contenders to test-drive, and have a good understanding of the various trim versions and features. Print out information on the models you’re interested in from CR.org and manufacturer websites to take along with you.

Buy something reliable. If you can’t get a deal on a used car or are forced to pay a high price to finance one, you may find yourself looking at older models that you wouldn’t otherwise have considered. CR recommends taking any used car to a reputable mechanic to have it inspected. (If the owner or dealer balks at this request, you may be better off looking elsewhere.) You can also consult CR’s predicted reliability scores to make sure you buy something that won’t give you problems later.

Be willing to compromise. If you have to buy an older car, some of the features you want—whether advanced safety and driver assistance features or connectivity—may not be available. Decide which are absolute must-haves, but be flexible on the rest. As always, you’re more likely to find deals among less sought-after models like small sedans and front-wheel-drive SUVs, while larger SUVs and pickups are likely to be more expensive and quicker to sell.

Don’t borrow too much. Put as much money into a down payment as you can afford. Good advice in any economic climate, maximizing your down payment will reduce the amount you have to pay in interest on the rest, and minimize the chance that you’ll be left hanging as your aging car’s value sinks over the years, particularly with used-car prices still relatively high.

For example, if you have to borrow $15,000 for a used SUV that will be worth less than $10,000 in a year or two, you may end up “underwater,” or owing more than the car is worth, especially with the average interest rate on a car loan at over 6 percent. If you crash the car or if it’s stolen, you’ll still have to make payments. Cars are depreciating assets in the best of times, but they’re likely to depreciate much more quickly if and when prices come back down to “normal” levels.

Buy back your lease. If you’re coming to the end of your lease, consider buying it back. If you signed your lease before used-car prices began going crazy early in 2021, the contract details—and all the number-crunching to figure out the car’s future value at the end of the lease—will have put the buy-back price well below the current market value. In other words, you can buy your own car for less than you would have if you had to buy it from a dealer. Or, says Nana-Sinkham, you might find that the favorable lease terms you got a few years ago no longer exist, which means buying your lease could keep you from having to make a bigger down payment and higher monthly payments on a new lease.