Medicare Part B is the outpatient coverage portion of Original Medicare (Medicare Part A and Part B). Medicare Part B helps cover medically necessary outpatient services and supplies that are needed to treat and prevent medical conditions. If you are eligible for Original Medicare, enrolling in Medicare Part B is essential. By doing so, you will avoid late enrollment penalties and become eligible for supplemental coverage to help reduce your out-of-pocket responsibility.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Some examples of Medicare Part B covered services include doctor visits, durable medical equipment like oxygen and wheelchairs, certain vaccines, and more. However, you are not covered 100%. Medicare Part B leaves you responsible for certain deductibles and copayments when you receive care.

Below, we review what Medicare Part B covers and how it can benefit you once you are eligible for coverage.

What is Medicare Part B?

Medicare Part B is one-half of Original Medicare (Medicare Part A and Medicare Part B). Part B covers doctors’ visits, outpatient care, and durable medical equipment when deemed medically necessary. Additionally, Medicare Part B covers preventive and medically necessary services that you receive under the supervision of a Medicare-accepting physician.

Medicare Part B costs include a monthly premium that is determined by your annual income. Most enrollees pay the standard Medicare Part B premium which is $174.70 in 2024. However, if your household makes above a certain amount, you may be required to pay a higher premium known as the Income-Related Monthly Adjustment Amount.

Once you enroll in Medicare Part B, you become eligible to enroll in a Medicare Supplement plan or a Medicare Advantage plan. These plans help reduce your medical spending and may help cover additional benefits. It is important to research both plan types and all available options in your area prior to enrolling in coverage. There are several plans to choose from so you’ll want to ensure you enroll in the best plan for you.

Medicare Part B Eligibility

To enroll in Medicare Part B, you must meet specific criteria set by the Center for Medicare and Medicaid Services (CMS). If you already receive Medicare Part A, you are automatically eligible for Medicare Part B. All you need to do to receive coverage is enroll and pay the monthly premium.

However, if you are new to Medicare, you must meet the following criteria:

- Must be a U.S. citizen for at least five years

AND one of the following

- Age 65 or older

- Under 65 and receiving Social Security disability benefits for at least 24 months

- Diagnosed with Amyotrophic Lateral Sclerosis

- Diagnosed with End-Stage Renal Disease

You can enroll in Medicare Part B if you meet the above requirements, regardless of your age. If you are unsure whether you are eligible for Medicare benefits, the easiest way to know for sure is by contacting your local Social Security office.

Listen to this Podcast Episode Now!

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

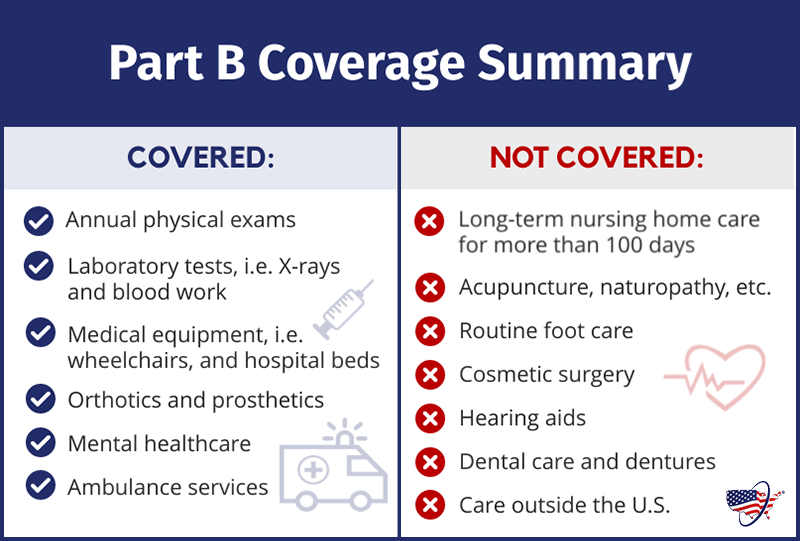

What is Covered by Medicare Part B

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive services.

Medically necessary coverage encompasses a variety of tests, procedures, and care options. A medical service or supply must be a requirement for treating or diagnosing a medical condition for Medicare to consider them medically necessary. Each situation is different, so a medical supply or service deemed medically necessary for one person may not be for another.

Typically, you are responsible for covering the Medicare Part B deductible, then a 20% coinsurance when you receive medically necessary care.

Preventive care, on the other hand, are healthcare services that help prevent and detect medical conditions before they become more advanced or life-threatening. Preventive care can include screenings, vaccines, tests, routine exams, and more.

When you receive preventive care through Medicare Part B, you are not required to pay the deductible or coinsurance.

It is easy to keep up with your general health needs through Medicare Part B outpatient insurance by utilizing annual wellness visits to undergo preventive and routine care each year.

Medicare Part B Coverage

Medicare Part B covers a variety of outpatient preventive and necessary services.

Part B Medicare benefits cover the following preventive care services:

- Vaccines

- Annual Cancer Screenings

- Lab Work

- Mental Health Counseling

- Screening colonoscopies

- Mammograms

- And more

Alongside preventive care services, Medicare Part B covers certain outpatient services and medical equipment you receive. These include:

- Surgeries

- Diagnostic Imaging

- Chemotherapy

- Dialysis

- X-rays and Lab Work

- Wheelchairs

- CPAP Machines

- Ambulance Services

- And More

If you are given drugs while at the hospital, Medicare Part B will also provide coverage for these services. However, prescription medications are typically covered by Medicare Part D.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

What Does Medicare Part B Not Cover?

Medicare Part B only covers specific services performed by medical professionals who accept Original Medicare Coverage. Unfortunately, there are several services not covered by Medicare Part B.

Medicare Part B does not cover:

- Dental

- Vision

- Hearing

- Prescription drug coverage

Further, it does not cover anything not considered medically necessary or preventive, like cosmetic surgery, nor any medical services provided by non-Medicare-participating providers. Additionally, all inpatient services are covered under Medicare Part A coverage.

What is the Difference Between Medicare Part A and Medicare Part B?

Medicare Part A and Medicare Part B are the two parts of Medicare that makeup Original Medicare coverage. For most, Original Medicare is your primary healthcare coverage once you reach age 65 or receive disability income. The difference between Medicare Part A and B is that Medicare Part A handles inpatient services and benefits, whereas Medicare Part B covers outpatient, doctor, and medical supply benefits.

The two coverages work hand in hand but are not the same in terms of cost and benefits. Often, you will not need to pay a premium for Medicare Part A. However, you will need to pay a monthly premium for Medicare Part B. Regarding out-of-pocket costs, both parts of Medicare require you to pay deductibles, coinsurance, and copayments. However, those costs look very different between the two parts.

How Do I Apply for Medicare Part B?

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically enroll. If this is the case for you, you will receive your Medicare card one to three months before your 65th birthday. You must register yourself if you are not collecting Social Security benefits. You can apply for Medicare Part B online, over the phone, or in person.

All beneficiaries will have an Initial Enrollment Period for Original Medicare. Your Initial Enrollment Period begins three months before your 65th birth month and ends three months after you turn 65. If you do not enroll during your Initial Enrollment Period and do not have creditable coverage, you could be subject to a penalty when you decide to enroll.

Can I enroll in Medicare Part B at Any Time?

To enroll in Medicare Part B, you must have a valid Part B enrollment period.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

When you first become eligible for Medicare, you will have an Initial Enrollment Period. If you do not enroll during this time, you must wait until the General Enrollment Period to enroll in coverage. The only exception to this is if you qualify for a Special Enrollment Period.

If you qualify for a Special Enrollment Period, you receive an individualized time to enroll in Medicare Part B without penalty based on a special circumstance. It is essential to utilize these opportunities if you have the chance. If you do not have a Special Enrollment Period, you may be required to pay a Medicare Part D late enrollment penalty.

51 thoughts on "Medicare Part B"

To the medicarefaq.com admin, Your posts are always on point.

Hi, I am 67years old and working full time. My husband was “let go” from his job before he was 65. He is 68. I started working when he first lost his job. He worked for a little bit, but has been not been working for the last 2 years. . He is taking social security. I am singing up for medical insurance from my work and I am trying to see if it is worth it to keep him on my insurance. The new plan for both of us would cost approximately 400.00 a month; (a bit more including dental and vision) because I need a plan that is not an HMO. Should he enroll in Medicare part B now; should I? I just don’t know how to figure out what to do.

The best way to decide which coverage to choose is to do a side by side comparison of your employer benefits vs Medicare benefits. You should compare monthly costs, out-of-pocket costs, coverage, and network availability.

I draw social security surviors benefits from my dad cause ive been disabled before age 22 and im on a medicare advantage plan with people having there medicaid taking away cause of the unwinding period what will happen if they take mine will i have to pay a part b premium if i dont have it

If you do lose Medicaid, you would become ineligible for a dual Special Needs Medicare plan. Thus, you would become responsible for your Medicare Part B premium. This amount would likely be deducted from your Social Security check each month.

I was denied an appointment by a provider who normally accepts Medicare patients. The reason — I have not yet paid my Part-B deductable for 2023. I thought the provider is supposed to bill Medicare for services provided, Medicare will bill me for the part that is deductable, then pay the provider up to 80% of the billed amount and the provider will bill me (or my Plan-G carrier) for any remainder. Please clarify.

Hi Charles. I am so sorry this situation occurred. When you have Medicare, meeting the annual deductible is required before Medicare will cover any part of your service. Typically you are spot on – when seeing a doctor who accepts Medicare, you will receive care, the office bills Medicare and then Medicare will bill you for your deductible, then Plan G should cover the remainder after the deductible. Does this provider still accept Medicare patients? It could be an issue of them not accepting Medicare benefits any longer.

Does a gap in medical coverage before the age of 65 affect the amount you’d pay for medicare?

Say I’m 60 and miss a month of having medical insurance. Will this affect the premium amount for medicare once I turn 65?

Hi Tim! A gap in your coverage before age 65 will not impact your Medicare rates so long as you were not eligible for Medicare before 65 (disability).

I have not taken part B because I have an employer plan covering both my wife and myself. I am retiring and will have to sign up for part B as I have been collecting SSI for two years. My wife has not started SSI because we want to wait for her to turn age 70. Do I have to enroll her in part B at the same time as I am due to the company policy being void?

To avoid a late enrollment penalty for your wife, you would need to enroll her in Part B once you lose group coverage.

My husband is covered under my insurance until I retire on September 1st. He will be 65 on May 25th and is currently collecting SS. I understand they will start deducting his monthly premium automatically. Is there an easy way to delay coverage for him so he does not have to pay the monthly premium until September 1st? I am afraid if I try to do this things might get messed up and he wont be covered.

Thanks!

Kim

Kimberlyn, as long as your husband is covered by creditable health insurance, he will have no problem delaying Medicare Part B. Contact your local social security office to delay his Medicare coverage.

If my husband chose to take Medicare Part B since he is eligible and he is also covered under my work health plan, Will Medicare Part B pay what is not paid from my primary insurance company as in the 20 percent or would part B deny because my primary already paid 80 percent? .

Sherry, it is important to speak with your group plan administrator to ensure the plan will coordinate benefits with Medicare. Typically, once the group plan pays its part, you will be required to meet the Medicare Part B deductible. Once you meet the Medicare Part B deductible, Medicare will cover 80% of the remaining balance.

If I sign up for a Medicare Advantage Plan, do I still have to pay the $170 a month for Medicare? I am so confused…..

Misty, yes! If you are enrolled in a Medicare Advantage plan, you are still responsible for paying the Part B premium each month.

Hello!! My name is Dan Wolfe and I just sign up for Medicare A-B. I’m 67 years old. I need a treatment called IVIG. Nobody can tell if Medicare will cover this treatment. I also have supplement part G. Is there anyway you can help me out. I had this treatment before that my company insurance paid. Any help would be great. Found your information on the web. Thank you Dan

Dan, thanks for reaching out! IVIG is covered under Medicare Part B if the treatment is deemed medically necessary by your physician. Medicare Part B will cover in-office infusion or at-home infusion. This means that you will only be responsible for the Medicare Part B deductible (if not already met) and your Plan G will cover the remaining costs.

I have Medicare part A, my husband will retire in April at age 66 and 6 months, when should I apply for Medicare part B and can apply online I was told because I have part A I couldn’t apply online

Shirley, you can apply for Part B up to 3 months before you want it to be active. You will need to call Social Security to complete your enrollment.

I just signed up to start receiving SS Feb. 1, 2022, my 65 birthday. I checked off that I wanted Medicare Part B and I also have health insurance thru my husband’s company. Do I need to do anything else??

Hi Pauline – we recommend taking Part A because it is premium-free if you’ve worked and paid Medicare taxes for at least 10 years. If you have insurance through your husband’s company, you can actually waive Part B if the employer insurance is creditable. It will be creditable if the company has at least 20 employees.

I will be 65 in Feb 2022 and will keep working until I am 66 1/2 in 2023. I am keeping my group health insurance through work until I retire. As required, I just signed up for Medicare Part A. Do I have to sign up for Part B now or can I wait until my retirement year without penalty?

Hi Penny – Part A is not required but it is very strongly recommended that you take it, so it’s good that you did. Whether you can wait to sign up for Part B without penalty depends on whether your group health insurance through work is creditable. If your employer has fewer than 20 employees, you will face a penalty for delaying Part B. On the other hand, health insurance through an employer with 20 or more employees is creditable and you can waive Part B penalty-free until your retirement. Then, you will get a Special Enrollment Period for (voluntary) loss of coverage.

I live in Michigan and retired from Ford motor Company and collecting social security

and have Medicare part A and B why is it that I have to have a private insurance

such as a company called in Michigan HAP what does it cover Thanks

Hi Joseph – what you’re describing is a Medicare Advantage plan. You are not required to have private insurance in addition to Medicare; if you prefer, you can keep Original Medicare. In that case, you’ll need to cover the 20% coinsurance for Part A and Part B. If you want 100% coverage, Medicare Supplement plans are available for the price of a monthly premium.

Hi, I’m currently on Medicare Part A and Part B. I also have group health insurance through my employer. We’re a small group, under 20 employees and our group insurance company previously required insureds to have Part B if they are eligible for Medicare. Recently the group insurance company sent a letter advising that they are changing how they coordinate benefits for Medicare Part B. The letter states beginning 01/01/2022 if I am not enrolled in Part B, the group insurance will be the primary payer. Our company’s insurance broker recommends I disenroll in Part B to save on the cost of the premiums. I’m hesitant to do so because of the potential penalty in the future for late enrollment. Your thoughts? Thank you.

I have been on SSDI since 2014 and was briefly taken off from Aug 2019 until Aug 2020, since I tried to go back to work. I was informed since my SSDI was cancelled my Medicare parts A & B we’re also cancelled.

Once my SSDI was reinstated, Aug 2020, my premium ($148.50) has never been taken out of my monthly check. Medicare.gov says I have original Medicare. I’m assuming Part A only?

Do I need to somehow add Part B before I apply for an Advantage Plan? If so, will I be required to repay the monthly premium for the year I want receiving Medicare? I have gotten so many different answers I’m not sure what my ideal route needs to be.

Also do I absolutely need Part B?

Hi Dennis – if you want to join an Advantage plan, you will first need to enroll in Part B. Now, whether you’re required to pay back the monthly premium will be determined by Social Security. Ultimately, it depends on whether your Part B is backdated or if they give you a new effective date.

My husband will retire in a few months. His union offers an Aetna medicare indemnity PPO. How does this fit in with the Medicare parts? It seems like part B with added benefits. Will a part G still pay the 20% that this does not cover?

Hi Marylou – the PPO plan to which you refer is a Medicare Advantage plan. These types of plans stand-in for both Part A and Part B, also providing benefits like dental/vision/hearing and prescription drug coverage. Plan G is a Medigap plan, which you cannot have alongside a Medicare Advantage plan. Additionally, if you choose to go with Medigap, you’ll need to enroll in a standalone Part D plan for prescription drug coverage.

What is the Medicare Part B yearly deductible??

Hi John – for 2021, the Part B deductible is $203. However, that amount is subject to increase in 2022 and the public will soon know next year’s dollar amount.

Questions regarding part B

I will be 65 in September and recently applied for Medicare, however I was just informed that since I will begin drawing my deceased spouse’s Social security first delaying mine until age 70, that I should file for Medicare under her record so the premium payment comes out of my spousal benefit. How do I correct this error?

Hi Brenda! You will want to contact Social Security or Medicare directly to update your account accordingly. You will need to pay your Part B premium through your MyMedicare dashboard until this is updated to avoid a lapse in coverage.

What if you don’t live in the USA?

Hi Nick! If you have another form of international health coverage, it may be creditable coverage. There is very limited documentation on what international health insurance is considered creditable under Medicare. You would need to contact Medicare directly to make sure. If you don’t have any coverage, you will be penalized for not enrolling when you were first eligible, even if you are not living in the USA.

Hi, I submitted my online application for Part B medicare (I have part A for a while now) and they received it 6/20/21. I have not received my new medicare card in the mail for A & B as of yet. If I have to see a doctor (currently having some pain) what can I do at this point?

Hi Kathy! Have you created an account in MyMedicare.gov? You may be able to see your Medicare number in your dashboard to provide your doctor with.

Hello, if I have only Medicare Part B. Will my outpatient doctor/Clinics visit covered outside my resident State?

Hi Markeya! Yes, Part B will travel with you nationwide. You will have 80% coverage for any outpatient medical costs.

Hello. As a retired Federal employee, I have FEHBP coverage with UHC-MD/IPA., an HMO. I didn’t sign up for Medicare when I became eligible in 2011. The part B premium will cost 148.50 plus a substantial late filing penalty when it kicks in July 2021 as I only signed up for Medicare last summer. Would I be better off dropping Part B? I don’t want to pay more that I have for Part B type services covered by the HMO. Many thanks for your advice.

Hi Larry! Most FEHB plans offer a “coordination of benefits” with Medicare. The coordination cut costs by waiving deductibles, copayments, and coinsurances. Your penalty will continue to increase, the longer you wait to enroll the more your premium will be if you do enroll in the future. So, yes you can drop Part B, but that may not be the best choice in the long run since we cannot predict our healthcare costs. We have more on FEHB and Medicare benefits here.

If you are being billed for part B and are now ready to sign up for SSI will they

start taking it out of your SSI or do they still bill you.

Hi Deborah! Once you draw SSI, you should see the Part B deductible start to automatically come out of your check.

What form does an out of network provider fill out in order for patient to receive reimbursement

Hi Norman! If you have a Medicare Advantage plan I would contact your carrier directly to get the correct forms necessary. Normally, you’re responsible for 100% of the cost if the provider is out of network.

How do I submit to Medicare for my provider accepting only at the time of the appointment and does not bill insurance?

Hi Barbara! You will need to complete the Patient Request for Medical Payment Form (CMS-1490S) and submit it to Medicare through your MyMedicare account. It must be complete no more than 12 months after services were received.